Legacy Planning

Charitable trusts

Charitable Trusts

Maintaining financial health for oneself, your spouse, children, loved ones, and supporting the ministry can be a challenging task. However, there are multiple ways to make your assets work for you and your family, and continue impacting precious lives with the life-transforming gospel of grace.

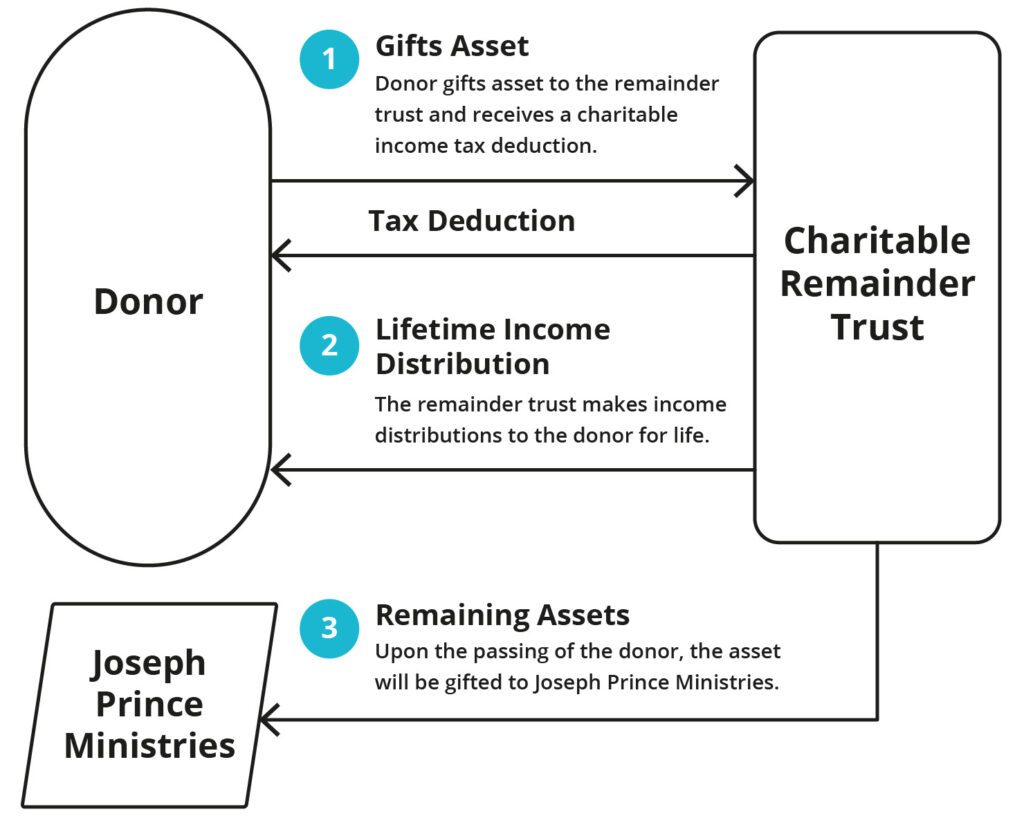

Charitable Remainder Trust

A Charitable Remainder Trust (CRT) provides many options and opportunities. Charitable trusts can be structured to provide a long-term gift to the ministry while giving your family income for life or over a number of years. They can also be set up to provide income to our ministry for a period of time, and then to return the remaining value of the trust to your family.

Receiving a lifetime income, tax benefits, and helping further the preaching of the gospel of grace can be accomplished with the same dollars. When assets like securities, cash, or real estate are irrevocably transferred to the trust, the trustee of your choice manages the trust and makes income distributions to you and/or others as specified in the trust document.

The income can be for life or a term, not exceeding 20 years. After the completion of all income payments to the beneficiaries, the balance remaining in the trust is distributed to one or more of your favorite charities (for example, Joseph Prince Ministries) named in the trust.

Charitable Remainder Trusts entitle itemizers to an income tax deduction, preferential treatment of capital gains tax and can be beneficial for those who have an estate that will be subject to federal estate taxes. Individuals should discuss tax implications with their personal advisors.

Creating a Charitable Remainder Trust can be an effective way for one to achieve financial and personal goals, as well as supporting the ministry for years to come.

How a Charitable Remainder Trust works:

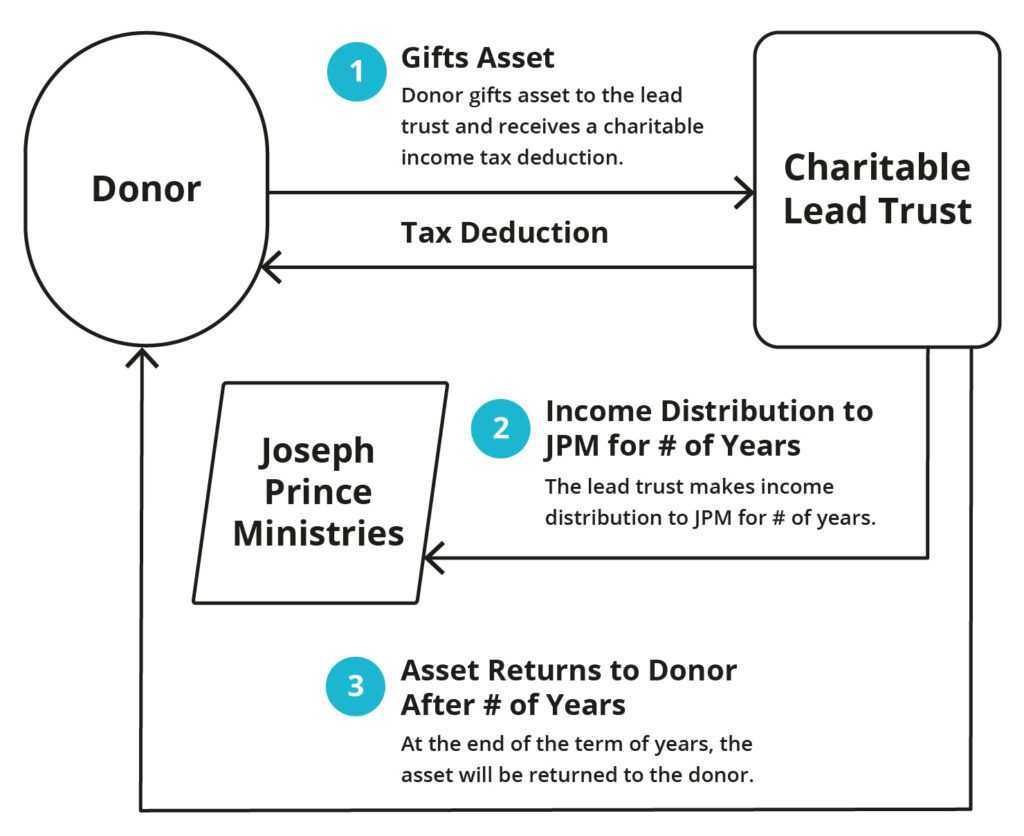

Charitable Remainder Lead Trust

This is another option available to make sure you and your family are well cared for while helping the ministry continue broadcasting the gospel of grace.

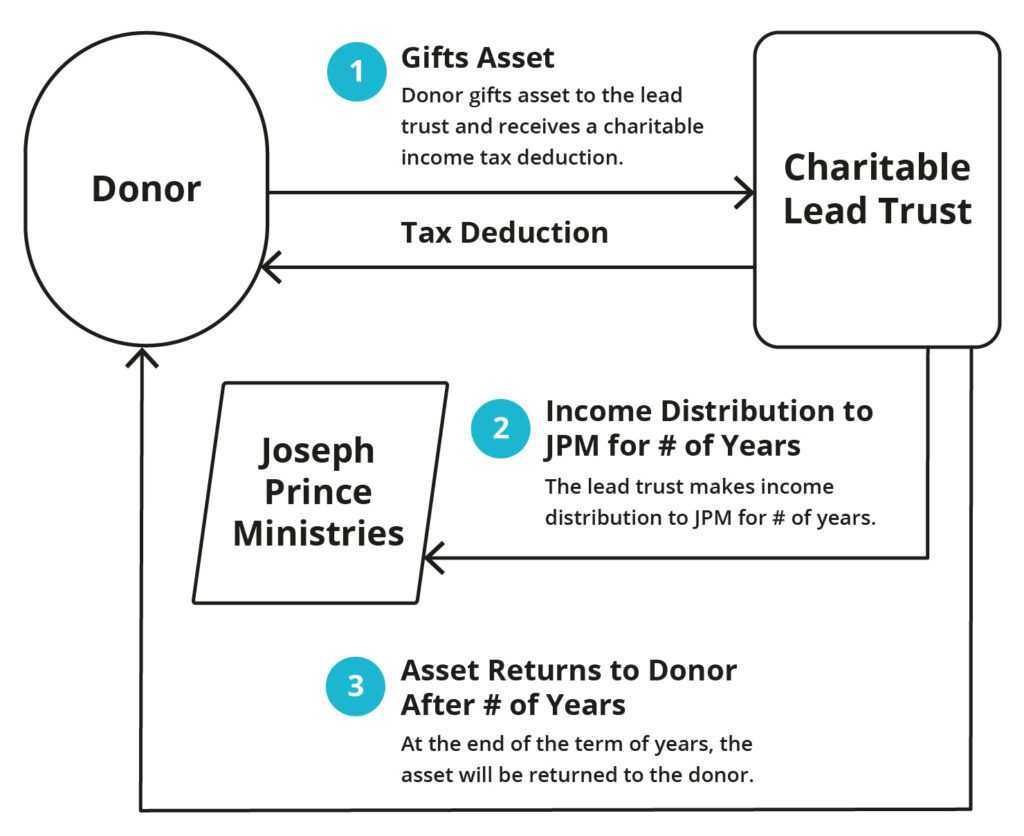

A Charitable Lead Trust provides the ministry with income payments for a term. When the trust term is over, the trust is distributed to you or your heirs. Although you temporarily forgo the investment income, you or your heirs ultimately receive the property.

How a Charitable Lead Trust works:

A Charitable Lead Trust can be structured to distribute the balance of the trust to you after the trust term ends. In this situation, you will receive an income tax deduction in the year you set up the Charitable Lead Trust, but you will be taxed on the trust’s income each year. Generally, this type of Charitable Lead Trust works well for individuals needing a large tax deduction in a particular year.

Leaving the Balance to Your Family

You can also structure the Charitable Lead Trust to transfer the balance of the trust to your family after the trust term ends. As you may know, the IRS imposes a transfer tax, called gift and estate taxes. However, the gift of the “lead” or income interest to charity creates a gift tax savings. Opting for this arrangement might be more suitable if you intend to pass assets on to your family, as it will reduce the tax incurred.